A Look Back and the Way Forward

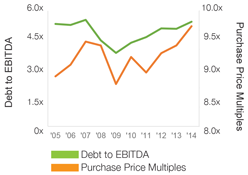

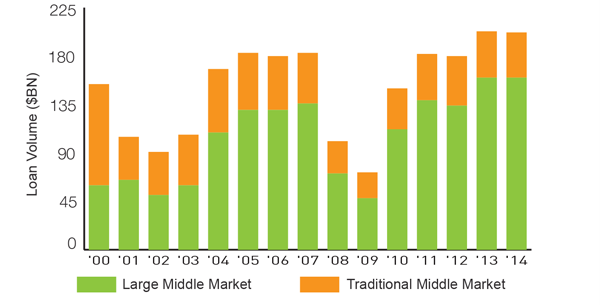

Middle market lending activity topped out at $202 billion in 2014—just shy of the annual high of $203.5 billion recorded in 2013. Large middle market volume accounted for roughly 80% of overall activity, with the remaining 20% coming from traditional middle market issuance (See Figure 1). Within the institutional middle market LBO space, the average purchase price multiple increased to 9.6 times and the debt to EBITDA level rose to 5.43 times (See Figure 2). Nevertheless, judicious private equity sponsors appear to be exercising discipline and prudence with respect to investment and leverage decisions.

U.S. Middle Market Loan Issuance

Source: Thomson Reuters LPC; Larger Middle Market Deal Size $100MM to $500MM. Traditional Middle Market Deal Size is less than $100MM.

From a sector standpoint, we favor industries with strong macro trends where our proprietary research unlocks potential value versus exposure to cyclical sectors. For 2015, the technology and healthcare sectors are likely to be standouts in our view (See Table 1).

Healthcare

From our perspective, service providers that save the government, commercial insurers, consumers and various other stakeholders’ money have a strong value proposition and should continue to see momentum in the medium term. Companies positioned to benefit the Big Three—the payor, patient and provider—will likely gain the most attention. On the flip side, we remain cautious of high margin, reimbursed businesses. As government payors target sectors/operating models where reimbursement cuts are justified, we anticipate that they will continue to be scrutinized.

Technology

We believe businesses with strong recurring revenues and those that help transition legacy systems into cloud computing offer attractive credit attributes. Cloud services companies typically exhibit significant operating leverage and can predictably grow to provide healthy returns on invested capital. As they generate incremental revenue and/or enhance clients’ operating margins, they often become highly engrained within client’s business processes. As a result, well-run technology companies should demonstrate less volatility than the broader economy in the event macroeconomic conditions deteriorate. On the other hand, we remain highly selective when it comes to investing in companies that are capital intensive given the volatility in commodities and increasing enterprise value and leverage multiples.

Fundamentals Strong Despite Capital Markets Volatility

Volatility notwithstanding, the middle market lending environment remains healthy overall and somewhat insulated from trends in the broadly syndicated lending market. Historically, borrowers have relied less on the syndicated market during tumultuous periods, accelerating opportunities for senior stretch and unitranche financing mandates. One-stop solutions in particular offer private equity sponsors a more seamless transaction with a greater certainty of close. As a result, we saw an uptick in one-stop transaction demand accompanying volatility spikes in the December quarter.

The above-mentioned volatility stemmed from macro-economic concerns, headlined by the precipitous drop in oil prices and a market technical backdrop that was in constant flux. The back-and-forth between supply and demand dictated the market sentiment for loans, with new-issue supply meeting periods of increased outflows from loan mutual funds. The resulting volatility was reflected in the ongoing fluctuation of average new-issue yields, which ultimately ended higher. For instance, over the December quarter, the average new-issue yield to maturity for middle market and broadly syndicated loans increased from 6.21% to 6.73% and from 5.52% to 6.34%, respectively (See Figure 3). While the overall market finished the year on a cautious note, energy credits continued to face increasing pressure as oil prices extended their now five-month slide—representing more than a 50% decline from the July 2014 highs.

New-Issue First-Lien Yield to Maturity(1)

Source: S&P Capital IQ LCD; Middle Market defined as issuers with EBITDA of $50MM or less; BSL (Broadly Syndicated Loans) / Large Corporates defined as issuers with EBITDA above $50MM.

De Minimis Energy Exposure Across Platform

Credit-focused asset managers have come under pressure due to concerns over exposure to energy and energy-related companies. However, while Keefe, Bruyette & Woods estimated that approximately 7.0% of overall BDC portfolios were invested in energy-related businesses, we have maintained a restrained approach.

With less than 2.0% invested in the oil and gas and related equipment services, our credit committee has consistently limited exposure to energy and other overbought or cyclical sectors. These investments have been stress-tested based on today’s market realities and we believe the reduced valuation of oil will have a minimal impact on the fair value of Fifth Street’s funds.

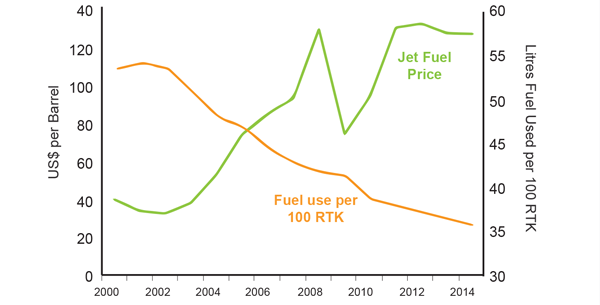

We see the decline in oil prices driving some investors away from certain assets, leading to interesting investment opportunities. For instance, the aircraft leasing industry stands to benefit from the decrease in oil prices (See Figure 4).

Fuel Efficiency and the Price of Jet Fuel

Source: IATA, IEA, Platts; RTK stands for Revenue Passenger Kilometers.

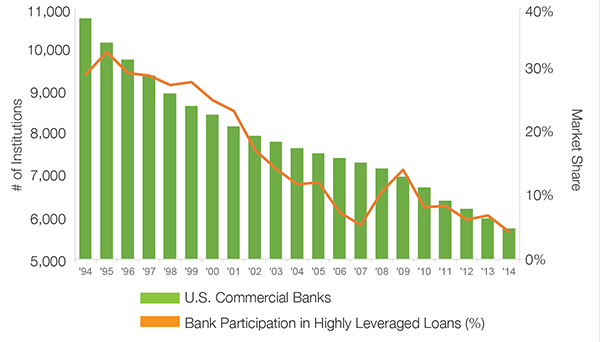

Bank Regulations Creating Greater Opportunities

From a secular perspective, changes that are unfolding are creating a favorable tailwind for middle market lending. Banks are under increasing scrutiny today compared to even six months ago and assets continue to migrate off banks’ balance sheets as a result. In November, regulators released the 2014 Shared National Credits review covering bank loan portfolios and underwriting standards. The review, which was generally negative, saw criticized portfolio assets jump from 10% to 13%—following four flat/improving years. Moreover, regulators noted “serious deficiencies” in banks’ underwriting and risk management standards for leveraged loans.

As regulators become increasingly focused on curtailing leveraged lending at banks, non-bank institutions appear well-positioned to take advantage of the investment opportunities that arise.

As bank competition increasingly retreats, the pipeline of opportunities is growing deeper, creating a very healthy backdrop for 2015 in our view. The key is to remain highly selective and maintain prudent underwriting standards in an environment that has otherwise seen increasing leverage levels.

Bank Market Share (%)(1) and # of U.S. Commercial Banks

Source: Federal Financial Institutions Examination Council (US); S&P Capital IQ LCD.

Fifth Street Activity

Active December Quarter Leads to Strong Originations

Driven by our leading middle market origination platform, which sources loans with strong risk-adjusted returns across the capital structure, we closed $1.3 billion in gross originations across Fifth Street funds during the December quarter. A significant portion of the gross originations generated in the quarter came from being awarded full financing mandates from newer sponsor relationships, while remaining active with our existing sponsor base. Over the past year, Fifth Street has been making inroads with several new top tier sponsors and after participating in several transactions alongside them, we have been able to win mandates outright thanks to our thoughtful and flexible financing solutions.

Syndication Platform Gaining Traction

Over the course of the 2014 calendar year, the Fifth Street platform closed $3.0 billion of investments across 125+ deals and agented and syndicated $1.8 billion of deals.(2)

The pipeline of potential capital markets transactions continues to increase with dozens of investors evaluating up to $300 million in syndication opportunities across seven new transactions.

Strategic Partnerships

We continue to make significant progress in both funding and expanding our joint ventures at our two BDCs, Fifth Street Finance Corp. (“FSC”) and Fifth Street Senior Floating Rate Corp. (“FSFR”). The ability to attract experienced institutional investors as partners is a further vote of confidence in Fifth Street’s origination platform, underwriting and portfolio management expertise.

As of December 31, 2014, Senior Loan Fund JV I LLC, FSC’s joint venture with a subsidiary of the Kemper Corporation had total investments of $250 million in a range of one-stop and senior secured loans to 23 portfolio companies. In line with initial projections, the joint venture has provided a mid-teens weighted average annualized return on investment. In November 2014, we announced the formation of FSFR Glick JV LLC, a joint venture with an entity controlled by members of the Glick Family. FSFR is in the process of obtaining a leverage line to optimize returns in the joint venture.

We have ample capacity to grow these and other similar joint ventures, in addition to other investment vehicles for institutional clients. The breadth of our origination platform enables us to provide structured investment solutions through Separately Managed Accounts as well as allocate deals to the third Senior Loan Fund that we are currently raising.

DISCLAIMER: Statements included herein may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, which relate to future events or Fifth Street Asset Management Inc.’s (“Fifth Street”) future performance or financial condition. These statements are based on certain assumptions about future events or conditions and involve a number of risks and uncertainties. These statements are not guarantees of future performance, condition or results. Actual results may differ materially from those in the forward-looking statements as a result of a number of factors, including those described from time to time in our filings with the SEC.

The information contained in this article is summary information that is intended to be considered in the context of Fifth Street’s SEC filings and other public announcements that Fifth Street may make, by press release or otherwise, from time to time. Fifth Street undertakes no duty or obligation to publicly update or revise the forward-looking statements or other information contained in this article. These materials contain information about Fifth Street, its affiliated funds and general information about the market. You should not view information related to the past performance of Fifth Street and its affiliated funds or information about the market as indicative of future results, the achievement of which cannot be assured.

Nothing in these materials should be construed as a recommendation to invest in any securities that may be issued by Fifth Street or its affiliates or as legal, accounting or tax advice. None of Fifth Street, its affiliated funds or any affiliate of Fifth Street or its affiliated funds makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained herein and nothing contained herein shall be relied upon as a promise or representation whether as to the past or future performance. Certain information set forth herein includes estimates, projections and targets and involves significant elements of subjective judgment and analysis. No representations are made as to the accuracy of such estimates, projections or targets or that all assumptions relating to such estimates, projections or targets have been considered or stated or that such estimates, projections or targets will be realized.

This article is not intended to be an offer to sell, or the solicitation of an offer to purchase, any security, the offer and/or sale of which can only be made by definitive offering documentation. Any other or solicitation with respect to any securities that may be issued by Fifth Street or its affiliates will be made only by means of definitive offering memoranda or prospectus, which will be provided to prospective investors and will contain material information that is not set forth herein, including risk factors relating to any such investment.